Flexible Financing Available for Every Homeowner

How Acorn Finance Works

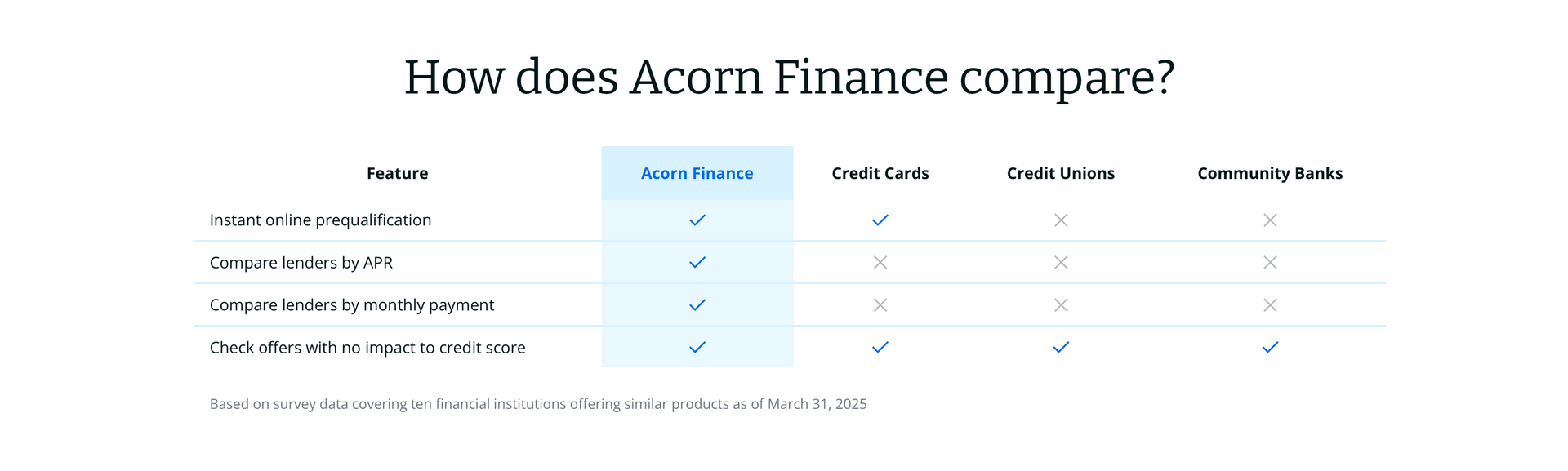

Acorn Finance connects you with a network of trusted national lenders so you can compare offers — all with one simple application.

Step 1 — Apply Online

Fill out a quick, secure application that takes just a few minutes.

Step 2 — Compare Multiple Offers

View personalized loan options from different lenders and choose the terms that work best for your budget.

Step 3 — Get Approved & Start Your Fence Project

Once approved, you can move forward with your fence installation and pay over time. Checking for offers uses a soft credit check and does not impact your credit score. A hard inquiry only happens if you select and proceed with a lender.

At A&K Quality Fencing, we make it easier to get the fence you need — without delaying your project due to upfront cost. That’s why we’ve partnered with Acorn Finance to offer simple, fast, and flexible financing options for qualified homeowners.

Whether you’re installing a new fence, replacing an old one, or upgrading for privacy, security, or curb appeal — financing helps you move forward now and pay over time.

Financing Highlights

Depending on credit and lender approval, customers may qualify for:

- Loan amounts from $1,000 up to $100,000

- Flexible repayment terms (often 2 to 12 years)

- Competitive interest rates

- Multiple lender offers to compare

- Fast approvals (often in minutes)

- Funding typically within 1–2 business days

- No dealer fees charged by AK Quality Fencing

Acorn Finance is free for contractors, which means AK Quality Fencing is able to offer financing without adding extra fees to your project.

Other Financing Options

Home Improvement Loans

As of this year, we now work with Home Improvement Loans (HFS) to provide more affordable options for all homeowners. We plan to help families save thousands this year on their new projects. Here are some benefits:

- NO MONEY DOWN

- LOW-INTEREST RATES

- FIXED RATES

- TERMS UP TO 20 YEARS

- DIRECT-TO-CUSTOMER FUNDED

Key Features & Benefits of HFS Finance

- Nationwide financing for homeowners in all 50 U.S. states.

- Direct-to-consumer funding: borrowers receive funds directly without staged payments or inspections.

- Quick, soft-credit prequalification: checking rates typically doesn’t affect credit scores.

- Flexible loan terms: financing options with terms available up to 20 years and amounts that support wide project scopes.

- Competitive rates and firm loan structures: tailored to the borrower’s profile and project needs.

Interested in our financing options? We’re here to help!

Call now and we’ll walk you through your options in minutes.